Coast Alerts

- Account Statements

- Cheques

- Credit Report

- Coast Capital Alerts

- Financial Checklists

- Drafts

- Replacement Debit Card

- Dormant Accounts and Unpaid Office Cheques

- Tax Receipt Schedule

- Transit Numbers

- Overdraft Protection

- Who is SEI?

- Worldsource View

- Resolving Your Complaint

- Safety Deposit Boxes

- High-interest Savings Account Changes

- Canada Deposit Insurance Corporation (CDIC): Protecting Your Deposits

- Wire Transfers

- Interac® sign-in service

-

Account Statements

-

Cheques

-

Credit Report

-

Coast Capital Alerts

-

Financial Checklists

-

Drafts

-

Replacement Debit Card

-

Dormant Accounts and Unpaid Office Cheques

-

Tax Receipt Schedule

-

Transit Numbers

-

Overdraft Protection

-

Who is SEI?

-

Worldsource View

-

Resolving Your Complaint

-

Safety Deposit Boxes

-

High-interest Savings Account Changes

-

Canada Deposit Insurance Corporation (CDIC): Protecting Your Deposits

-

Wire Transfers

-

Interac® sign-in service

Coast Alerts and Notifications can help you better monitor your finances, make informed banking decisions, and avoid paying unnecessary fees.

Coast alerts keep you updated on:

- Transactional activities (low balance, remaining credit, deposits, daily/weekly/monthly balances)

- Bill payees

- Unusual activity on your account

- Your budgets within Money Manager, Coast Capital’s personal financial management tool

There is no charge to receive Coast alerts. Ensure you’ve got alerts and notifications turned on to help you better manage your finances.

Helping serve you better.

This summer we started offering alerts for your personal deposit account and personal line of credit. These new alerts notify you when you have a low balance account or are about to exceed your remaining credit on your line of credit.

If your account balance or remaining credit on your line of credit falls below a specific threshold amount, you’ll receive an alert notifying you of this. By default, the threshold amount is automatically set at $100, but you can adjust this amount (see below for details).

Steps to make the most of your alerts.

Sign in to online banking or our mobile app, select Settings then Alerts & Notifications to customize the alerts you receive by:

Setting a threshold amount for your personal account balance or line of credit.

- You’ll receive an alert when you reach or drop below this amount. Coast Capital’s low balance account and remaining credit alerts’ default setting is $100.

Setting your preference for how you’d like to receive alerts.

- Low balance account and remaining credit alerts can be sent by email, text, or push notification through our mobile app.

- Email alerts are the recommended option, as text and push notification character limitations prevent them from containing the same amount of information as email.

If you don’t use digital banking, you can adjust your dollar thresholds by visiting a branch or signing up for digital banking (online banking and mobile app).

Turn off alerts

If you do not wish to receive any alerts, you can turn them off through digital banking, visit any branch OR submit a request by using our Contact Us form and selecting Alerts & Notifications – Turn Off.

What to do when you receive an alert

Upon receiving an alert, take time to review your account, its balance and upcoming transactions to determine if you are close to overextending your balance or exceeding your line of credit.

If your available account balance drops below $0 or you exceed your line of credit, you may incur a fee or charge as per Coast Capital’s Personal Accounts & Services Agreement and may incur fees for future transactions.

To avoid future fees (interest charges may still apply), make a deposit or transfer sufficient funds into the affected account or line of credit to avoid fees or interest charges. Don’t forget about upcoming payments that may be coming through your account and ensure you have a sufficient balance and/or credit to cover them.

If you need to speak to someone about being overextended, please call our Advice Centre at 1.888.517.7000 to speak to one of our helpful team members.

Your products and fees haven’t changed.

The new alerts for low balances on your personal accounts or remaining credit on your lines of credit haven’t changed any of the products and associated fees you have with Coast Capital. These alerts are a new service to help you better monitor your finances.

If you receive a low balance or remaining credit alert, it means your balance or remaining credit has fallen below $100 or the amount you have set for alert notifications.

Have confidence that low balance and remaining credit alerts are coming from Coast Capital.

You’ll know that alerts really are coming from Coast Capital because we’ll never:

- Direct you to a third-party website

- Ask you to sign into digital banking through the alert

- Ask for your username, password, PIN or other personal information in an alert

Here are step-by-step instructions on changing your settings and preferences for low balance and remaining credit alerts:

We have answers to some of your most commonly asked questions.

These are electronic messages sent to keep you updated on your account balances and transaction activity and bill payees, as well as provide you security alerts to spot any unusual activity.

This summer, Coast Capital is extending low balance alerts for ALL personal accounts and introducing remaining credit alerts for ALL lines of credit.

These will notify you if your personal account balance or the remaining credit on your line of credit falls below $100. Alerts will be sent by email, unless you change your preferences to receive them by text message after they are turned on this summer.

At Coast Capital, we’re always trying to provide you with better ways to manage your day-to-day banking and be in control of your finances. Low balance and remaining credit alerts help you keep an eye on your money and avoid unnecessary fees. We are committed to helping you protect your money.

No. This is a free service that Coast Capital is offering to all members with personal accounts and lines of credit who have provided an email address.

Upon receiving an alert, take time to review your account, its balance and upcoming transactions to determine if you have overextended your balance or exceeded your line of credit. Depending on your balance and recent transactions, you may have incurred a fee or charge as per the Personal Accounts and Services Agreement and may incur fees for future transactions.

To avoid future fees (interest charges may still apply), ensure you do not overextend your balance or exceed your line of credit by immediately making a deposit or transferring sufficient funds into the affected account or line of credit. If you need to speak to someone about being overextended, please call our Advice Centre at 1.888.517.7000 to speak to one of our helpful team members.

You can sign in to digital banking to make any changes you want, including turning them off. After signing in, go to Settings then Alerts & Notifications. You’ll be able to choose which accounts you’d like to receive alerts for or turn them off completely.

If you don’t use digital banking, you can submit a request to turn off Alerts through our Contact Us form (select Alerts & Notifications – Turn Off) or visit your nearest branch.

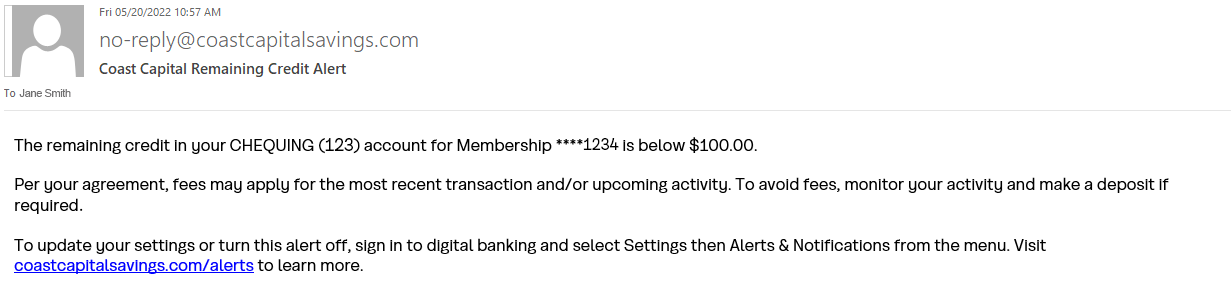

This is a sample of what a low-balance alert looks like.

|

Yes. You can update preferences, change threshold amounts and contact information, or turn alerts off completely using our mobile app.

Yes, you can customize your alert preferences for each account and line of credit. Just sign in to digital banking and select Settings then Alerts & Notifications. You will be able to select a different threshold amount for each account and alert type to help you manage your money responsibly.

Push notifications are an option available in digital banking; however, due to character limitations, low balance and remaining credit via alerts don’t include the same amount of information as email and text message alerts. We strongly recommend that you opt for email or text message alerts instead.