Explore other reasons to become a member all year round.

Learn more

It’s easy to become a member and earn cashback.

With everything in life getting more expensive, we want to help you keep more of your cash for the things you need.

Become a member and follow the steps below to earn cashback on your household bills.

Step 1: Become a member in as little as 5 minutes online.

By opening a Free Chequing, Free Debit, and More Account® with no monthly balance required.

Step 2: Start earning 20% cashback1 on your household bills, up to a maximum cashback bonus of $450.

Within the first 60 days after account opening:

- Make eligible1 bill payments or set-up pre-authorized debits

See FAQs section for links on how to make and set up bill payments and pre-authorized debits. that recur for 3 consecutive months or more.

See FAQs section for links on how to make and set up bill payments and pre-authorized debits. that recur for 3 consecutive months or more.  20% cashback will be received after the payment has successfully cleared your chequing account for at least 3 consecutive months, to the same bill provider Each payment must be at least $25.

20% cashback will be received after the payment has successfully cleared your chequing account for at least 3 consecutive months, to the same bill provider Each payment must be at least $25.

Earn cashback on payments like credit cards, utilities, cell phone, cable, mortgage, property tax, insurance, strata, gym memberships, car payments and more. See the FAQ section below for the list of exclusions.

This offer is only available to new, personal members who are residents of British Columbia. See terms and conditions.

- Make one or more eligible bill payments and/or set-up one or more eligible pre-authorized debits, for a minimum period of 3 consecutive months. Each bill payment or pre-authorized debit payment must be at least $25.

- 20% cashback will be received after the payment has successfully cleared your chequing account monthly for at least 3 consecutive months, to the same bill or pre-authorized debit payee.

- To get the full maximum cashback bonus of $450, the new member will have needed to make $2,250 in eligible payments. The longer the recurring payment is in the account, the more cashback the member can earn, up to $450.

Eligible household bill and pre-authorized debit payment categories include credit cards, utilities, phone provider, cable provider, child care, gym memberships, strata payments, property tax, mortgage, insurance, car payments, tuition, etc.

Only the following bill payment and pre-authorized debit categories are excluded: Any and all payments made to a PayPal, International Money Transfer Services (e.g., Wise or Western Union), short term/pay-day loans (e.g., National Money Mart, Cash Money Cheque, or Money Tree Canada), or any and all payments made via Interac® e-Transfer.

Pre-authorized payments to savings or wealth accounts are also excluded.

New members that join during the campaign period (January 16 – March 12, 2024) have until July 31, 2024 to earn 20% cashback on their bills, up to a maximum cashback bonus of $450.

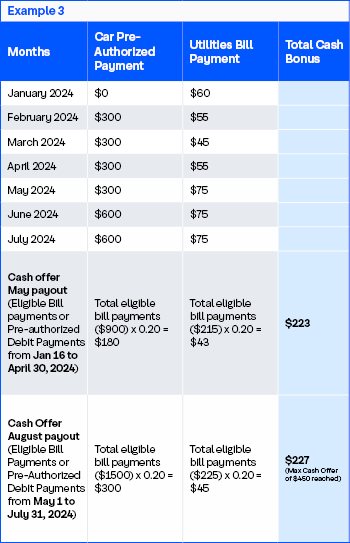

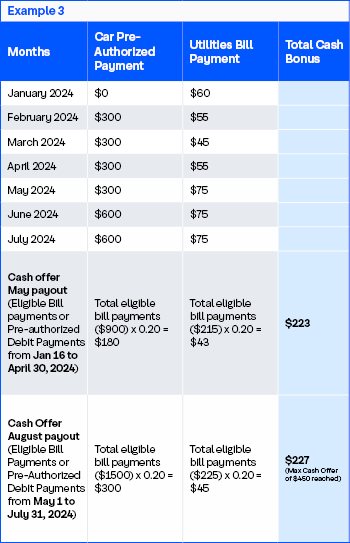

The first cashback payout will typically be deposited to the new member’s chequing account via electronic funds transfer within the month of May 2024. The May payout will be the sum of all eligible payments up to and including April 30, 2024 x 0.20.

The second cashback payout will be deposited to eligible members’ Coast Capital chequing accounts via electronic funds transfer within the month of August 2024. The August payout will be the sum of all eligible payments from May 1 - July 31, 2024 x 0.20.

If you do not qualify for the $450 maximum cashback bonus in time for the May 2024 payout, you can still qualify for the August 2024 payout.

For instructions on how to make or set-up bill payments, learn more here.

For instructions on how to set-up pre-authorized debits, learn more here.

How much do I have to spend in order to get the full $450 cashback bonus?

As a financial cooperative, all Coast Capital members are owners.

Join us and experience the difference a real financial partner makes.

Apply online in as little as 5 minutes.

- Up to a maximum cashback bonus of $450. Read full New Member Cashback Offer terms and conditions here. The following bill payment and pre-authorized debit payment categories are ineligible and excluded from the offer: Any and all payments made to PayPal, International Money Transfer Services (e.g., Wise or Western Union), short term/pay-day loans (e.g., National Money Mart, Cash Money Cheque, or Money Tree Canada), or any and all payments made via Interac® e-Transfer.

- Transactions include cheques, Coast Capital Savings® and EXCHANGE Network ATM withdrawals, Interac® Direct Payment, preauthorized payments, Coast-by-Phone® bill payments, Coast Online® Banking bill payments and in-branch withdrawals, transfers and bill payments. Deposits and self-serve (Coast Capital Savings® ATM, Coast-by-Phone® and Coast Online® Banking) transfers are free.Additional network ATM transactions are subject to the fees listed. Surcharges from other financial institution ATMs are excluded.

- Fee savings based on comparisons to average fees on chequing products charged by other Canadian financial institutions.