Solutions for Digital Banking

- Getting started with Coast Capital digital banking

- Digital Banking Help Videos

- Digital Banking FAQ

- Solutions for Digital Banking

- Automate Your Savings

- Pre-authorized Credit and Debit Form

- Personalized Experience

- Technical Requirements

- Alerts & Notifications

- Newest features

- INTERAC® e-Transfer

- Deposit On-the-go

- Paying Bills

- Transferring Funds

- eStatements

- Coast Capital Savings App for iPhone & Android

- Region Selector

- Line of Credit Amount and Borrowing Rate

- Online Term Deposit

-

Getting started with Coast Capital digital banking

-

Digital Banking Help Videos

-

Digital Banking FAQ

-

Solutions for Digital Banking

-

Automate Your Savings

-

Pre-authorized Credit and Debit Form

-

Personalized Experience

-

Technical Requirements

-

Alerts & Notifications

-

Newest features

-

INTERAC® e-Transfer

-

Deposit On-the-go

-

Paying Bills

-

Transferring Funds

-

eStatements

-

Coast Capital Savings App for iPhone & Android

-

Region Selector

-

Line of Credit Amount and Borrowing Rate

-

Online Term Deposit

This page is to help members who have followed the step-by-step process to getting started with their new digital banking and require some additional solutions for a successful experience. If you experience a problem not addressed below, please visit a branch or contact us at 1.888.517.7000.

What you’ll need for success

When it's time to upgrade to the new digital banking experience, you'll receive a notification when you log in to online banking on desktop, or you’ll get a prompt to download our new app. Be sure to have the following on hand to get started:

- Your current Personal Access Number (PAN) – the last eight digits of your Member/debit card

- Your current Personal Access Code – the seven digit access code you use for online and telephone banking.

Important things to note in the set-up process

- Be sure to check your junk email folder if you do not receive your one-time security code in the set-up process, or mark it as “not junk mail” to ensure it doesn’t go there again. Please note: As there may be a delay in the delivery of the one-time security code, please wait a few minutes to receive this key item in your email. Do NOT click the ‘Retrieve Password’ button multiple times.

What you’ll need to do for continued success

- Take measures to remember your new User Name and new Password. Do NOT write them down. Instead take time to create a mental association in your mind to recall them when needed.

- Once you’ve setup your username and password, you can no longer use your Personal Access Number and Code to log in to digital banking (Please note: this information is still important for contacting our Contact Centre). If you try to use these numbers for digital banking after three attempts you will be locked out for 24 hours.

- Forget your password? You can reset it yourself by using the self-serve option. Simply click the “Forgot Password?” button available on your phone, tablet or personal computer and follow the prompt.

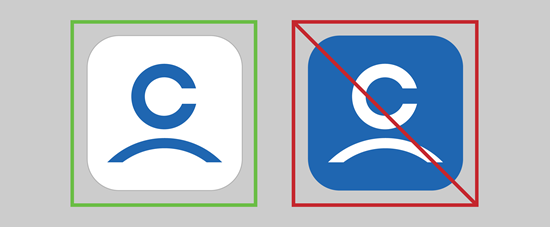

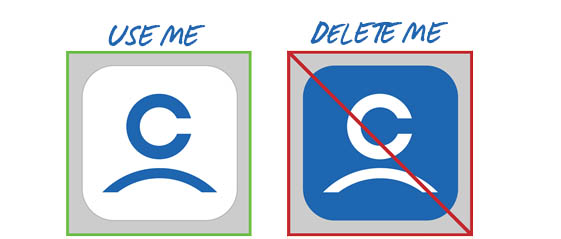

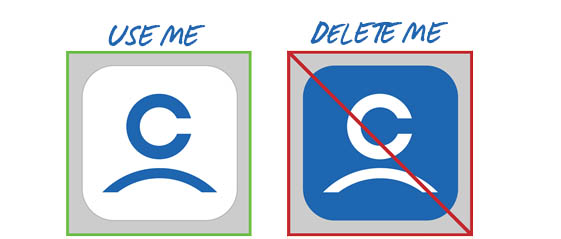

- Once you have migrated, do NOT use the Coast Capital App with the blue background and delete it from your mobile phone. Only use the Coast Capital App with the white background.

Trying to connect to a third-party financial aggregator tools (e.g. MINT)

Our functionality with Mint was impacted due to recent security enhancements. We are looking into whether this is something we are able to offer.

Trying to deposit a cheque with Deposit on-the-Go

If you’re experiencing issues with the Deposit on-the-Go, try the below troubleshooting steps:

- Click Settings on your phone

- Scroll down to application manager or the app list within the settings

- Click on the Coast Capital Savings application and clear the cache

- Once cleared, click on the Camera app under the application manager

- Click ‘Force Stop’

- Open the Camera app to test a picture

- Visit the app and attempt the deposit on the go once this is done

Simplifying the Login Process

Take advantage of our TouchID/Fingerprint ID feature by going to menu > security > setup fingerprint/TouchID.

Have more questions? We have more answers. Check out our digital banking FAQ.